Chairman's Desk

Guiding force of the Bank

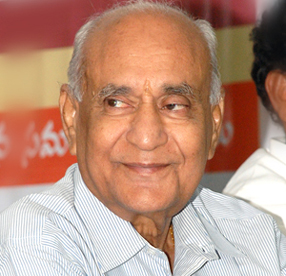

Personal Profile of Sri.Manam Anjaneyulu

Sri.Manam Anjaneyulu, a journalist, Trade Union Leader, particularly of un organized masses and above all a hard core communist, has taken the reins of administration of Visakhapatnam Co-operative Bank on 29/06/1983.He became a guiding force in developing the Bank from Rs.69,19,000/- deposit base in 1983 to Rs.2119 crores by the end of the year 2014, by virtue of his hard work, vision and leadership. His indomitable spirit made the Visakhapatnam Co-operative Bank Ltd., stand up like a giant in the Urban Banking Sector in the state of Andhra Pradesh expanding a unit bank to 35 branches in a span of 30 years of his chairmanship.

His services all these years are not limited to the Visakhapatnam Co-operative Bank Ltd., alone, but extended to national level Co-operative Urban Banking movement. He was responsible to bring all the bank managements of A.P under one roof, ’A.P Urban & Town Co-operative Banks Association’ in the year 1986, an exclusive state Organization affiliated to National Federation of Co-operative Urban Banks And Credit Societies Limited(NAFCUB).He was general secretary, and now Honorary President of the A.P Co-operative Urban Banks and Credit Societies Association.

He was Director and Vice-President of NAFCUB representing Co-operative Banks at National Level and the latest assignment as Director representing state level organizations. He was in the panel for several committees empanelled by Government including the Experts Committee and TAFCUB in the state of Andhra Pradesh and Member to Advisory Committee, Institute of Co-operative Management, Hyderabad. He authored several articles on different occasions and contributed to different vernacular dailies and magazines. He was a member of 10th A.P State Legislative Assembly. He was uninterruptedly chairman of the Bank ever since he was elected in 1983 to till he had handed over the responsibilities to Sri.CH.Raghavendra Rao. Some period he was also designated as chairman emiritus. He resigned to the post of director on 23.06.2024 and he is a permanant invitee to the Geneal Body of the The Visakhapatnam Co Operative Bank Ltd. He is admired as an icon of cooperative movement.

Chairman